Break-even Is Indicated on the Cvp Graph by:

Break-even is indicated on the CVP graph by. BREAK EVEN ANALYSIS GRAPH.

7 2 Breakeven Analysis Financial And Managerial Accounting

FX is the fixed costs CF is the variable costs and SC is the profit earned.

. 7-5 An increase in the fixed expenses of any enterprise will increase its break-even point. The graph shows the sales volume required to earn a particular target net profit. O the horizontal difference between the revenue line and the cost line.

ACCORDING TO CHARTERED INSTITUTE OF MANAGEMENT ACCOUNTANTS LONDON. B total profit equals total fixed expenses. The break-even point is where the total revenue line and the total cost line intersect on the CVP graph.

The margin of safety. The total cost y at any volume x equals a fixed component F plus a variable component V times the number of units of volume x ie. Costs and sales revenue are represented on vertical axis ie Y-axis.

A total profit equals total expenses. In a travel agency more clients must be served before the fixed expenses are. Break even Analysis is the analysis of three variables viz.

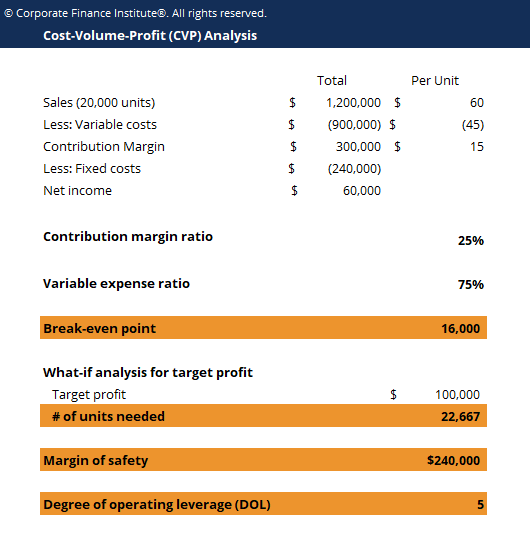

It is also known as Cost Volume Profit Analysis. Cost-volume-profit analysis looks to determine the break-even point. Multiple Choice total contribution margin equals total fixed expenses total profit equals total expenses.

Cost Volume Profit analysis break even. The breakeven point is when Revenue covers total expenses. Cost Volume and Profit which explores the relationship existing amongst Costs Revenue Activity Levels and the resulting Profit.

Some factors that can decrease central venous pressure are hypovolemia or venodilation. O the vertical difference between zero and the break-even point. A break-even chart portrays.

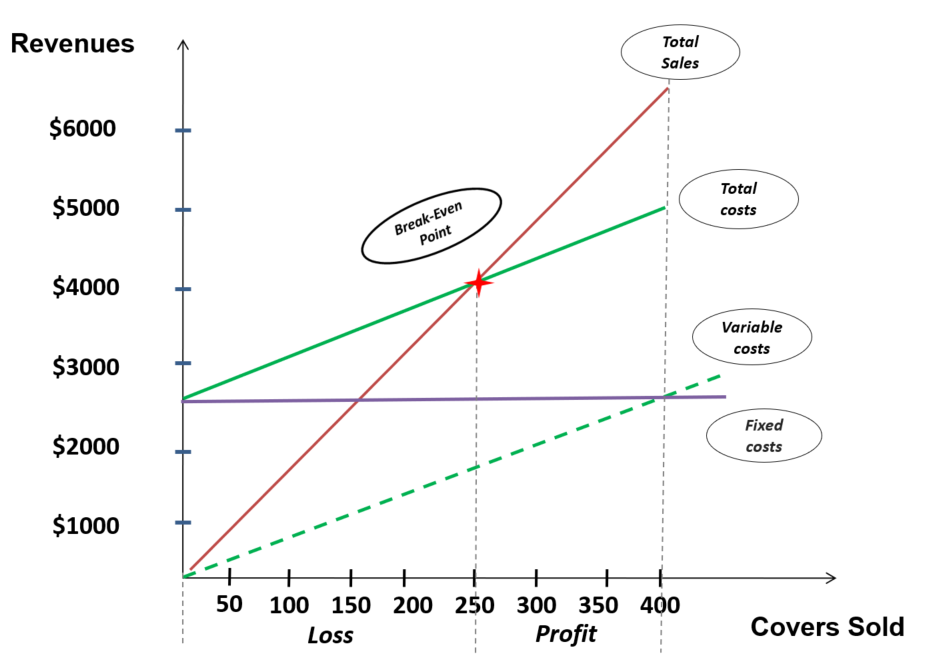

Fill in the missing data indicated by question marks. Formula for Break Even Analysis. The firms profit and loss areas are also indicated on a CVP graph.

Break even quantity Fixed costs Sales price per unit Variable cost per unit Where. View the full answer. Fixed costs are costs that do not change with varying output eg salary rent building machinery.

The break-even analysis is the study of cost-volume-profit CVP relationship. O Break-Even number of Units sold Break-Even number of units sold Fixed Costs Peso. It refers to a system of determining that level of operations where the organisation neither earns profit nor suffer any loss ie where the total cost is equal to total sales ie the point of zero profit.

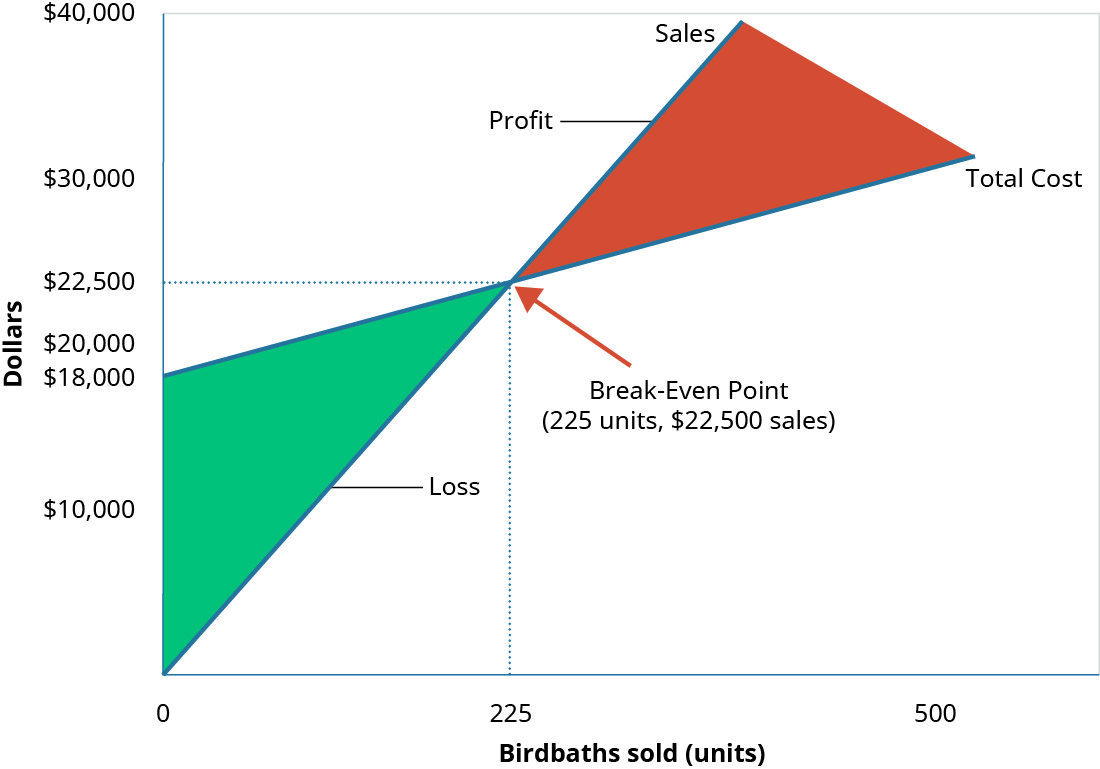

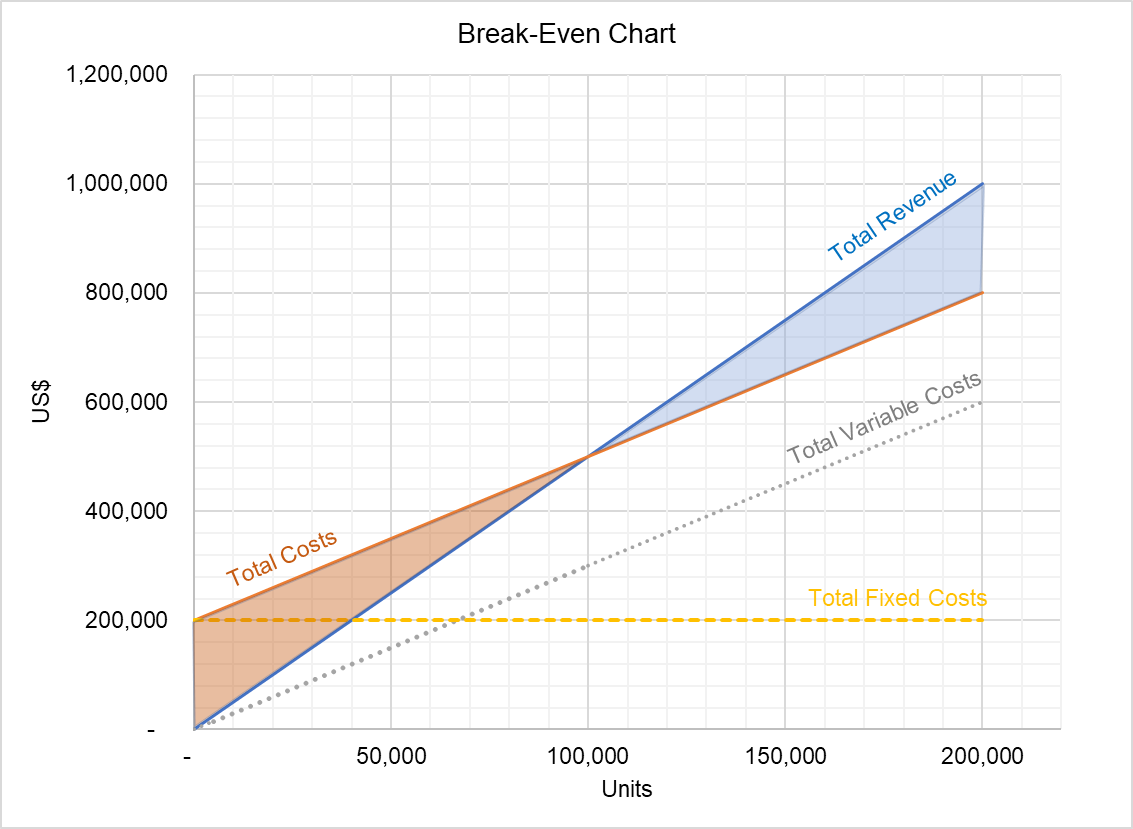

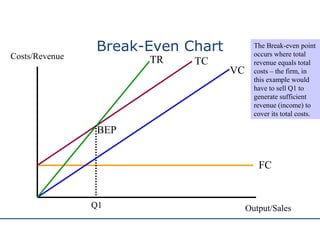

Profit is indicated on a cost-volume-profit graph by. A cost volume profit chart often abbreviated CVP chart is a graphical representation of the cost-volume-profit analysis. In addition to the break-even point a CVP graph shows the impact on total expenses total revenue and profit when sales volume changes.

There is no profit and no los. Volume is the units produced per machine run. Under this method following steps are taken to draw the break-even chart.

On a break-even chart the VOLUME IS INDICATED ON THE X-AXIS AS NUMBER OF UNITS produced and sold. Business Accounting QA Library Break-Even Sales and Cost-Volume-Profit Graph Last year Ridgecrest Inc. The firms profit and loss areas are also indicated on a CVP graph.

Likely profits or losses a different levels of output. Fixed Expense Php Php13464 Contribution Margin 28 Php48086 Break-Even formulas to be remembered. Sketch out a CVP analysis graph depicting the base case situation.

C total contribution margin equals total fixed expenses. O the vertical difference between the revenue line and the cost line. The relationship between marginal costs and fixed costs.

Volume of productionoutput or sales is plotted on horizontal axis ie X-axis. Either of these would decrease venous return and thus decrease the central venous pressure. The safety margin is the amount by which budgeted sales.

Total profit equals total fixed expenses total variable expenses equal total. Now assume that the practice contracts with one HMO and the plan proposes a 20. The costs and revenue- are indicated on the y-axis in terms of value rupees.

1 total contribution margin equals total fixed expenses. In other words its a graph that shows the relationship between the cost of units produced and the volume of units produced using fixed costs total costs and total sales. A careful and accurate cost-volume-profit CVP analysis requires knowledge of costs and their fixed or variable behavior as volume changes.

Cost Volume Profit CVP Analysis. The formula for break even analysis is as follows. Which of the following is correct.

The variable cost per unit was 280 and fixed costs were 836800. The rate of growth of profit-earning for a convenient unit of output. The break-even point occurs on the CVP graph where.

D total variable expenses equal total contribution margin. A shift upward and have a. Had sales of 3221680 based on a unit selling price of 440.

Required Sales Sales Php Targeted Profit Php Fixed Expense Php Contribution Margin Since targeted profit is zero the formula for the Break-Even Sales is. The break-even point occurs on the CVP graph where. The volume of sales or production may be expressed in terms of rupees units or as a percentage of capacity.

Sales price per unit is the selling price unit selling price per unit. O the horizontal distance between zero and the break-even point. Companies use cost-volume-profit CVP analysis also called break-even analysis to determine what affects changes in their selling prices costs andor volume will have on profits in the short run.

CVP analysis is also referred to as break-even analysis and it is an in depth interrogation of the relationship between cost volume and profit levels of a business at a particular period in time. The maximum sales within Ridgecrest Incs relevant range are 13000 units. The point where the total revenue line and the total cost line intersect.

So the break even point is indicated by the point at which the total cost curve intersects the total sales revenue curve because profit equals zero when total costs equals total sales revenues. 7-4 The safety margin is the amount by which budgeted sales revenue exceeds break-even sales revenue. The breakeven point in units of 250000 is calculated by dividing fixed costs of 300000 by contribution margin per unit of 120.

For cost y FVx. This B point is the break-even point.

Break Even Point Analysis Definition Explanation Formula Calculation Advantages Accountingexplanation Com

Break Even Chart A Business Supplies The Following Figures About Its Activities Fixed Costs 300 000 Variable Cost 20 Per Unit Forecast Output Ppt Download

Tutor2u Operations Introduction To Break Even Analysis

Creating A Break Even Chart Example

Figure No 1 Break Even Point Graph Download Scientific Diagram

Cvp Analysis Guide How To Perform Cost Volume Profit Analysis

5 6 Break Even Point For A Single Product Managerial Accounting

Chapter 15 Cost Volume Profit Cvp Analysis And Break Even Point Introduction To Food Production And Service

Break Even Wallpapers Music Hq Break Even Pictures 4k Wallpapers 2019

Angle Of Incidence Break Even Analysis Margin Of Safety Bba Mantra

An Increase In Income Tax Rate Affects The Break Even Point Explanation Qs Study

Break Even Analysis Barrons Dictionary Allbusiness Com

Pdf Cvp Analysis The Impact Of Cost Structure On The Result Of The Company

Break Even Analysis Graph Commerceiets

Break Even Analysis Graph Commerceiets

Break Even Point Analysis Mcq Free Pdf Objective Question Answer For Break Even Point Analysis Quiz Download Now

Comments

Post a Comment